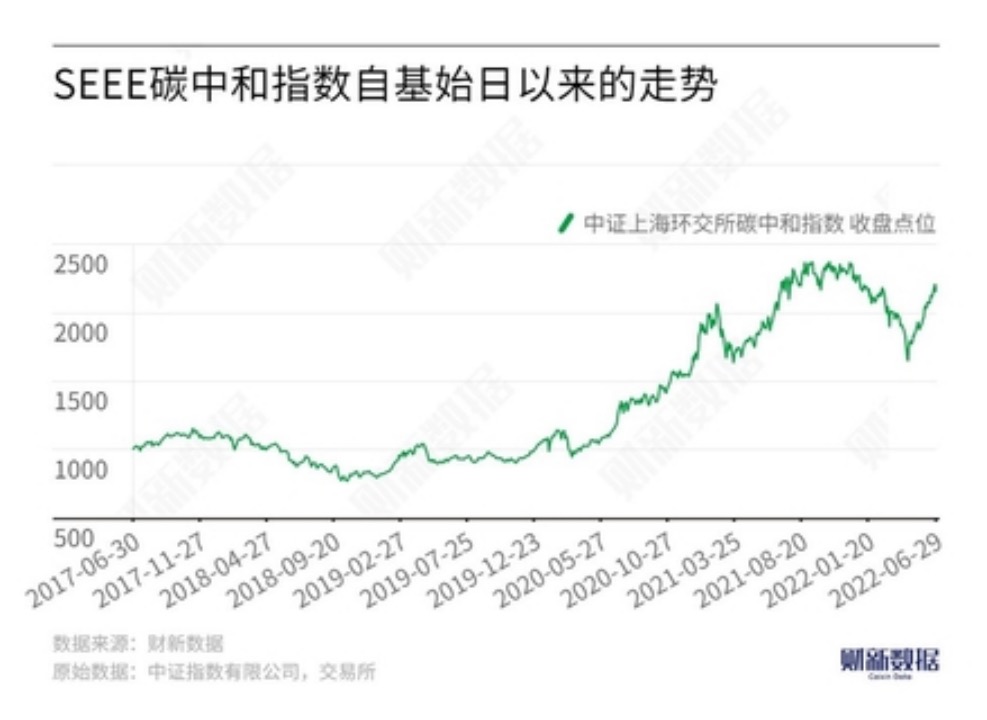

On June 28, the first batch of carbon-neutral ETF products was officially approved. These carbon-neutral ETFs track the Shanghai Environment and Energy Exchange (SEEE) Carbon Neutral Index, which was launched in November 2021 and reflects the overall performance of A-share listed companies that contribute significantly to achieving the national carbon neutrality target.

"This index means that the Shanghai carbon market and capital market have completed an organic integration, which is of great significance for promoting the development of green finance," said Zhao Yonggang, General Manager of the ESG Business Department of China Securities Index Co.

The SEEE Index covers the carbon-neutral beneficiary industries comprehensively and mainly selects stocks in the new energy and low-carbon and traditional high-carbon industries with greater potential for emission reduction as index samples. Among them, the new energy and low-carbon direction accounts for about two-thirds, covering areas such as clean energy and energy storage, green transportation, and decarbonization technologies.

Currently, the top ten constituents of the SEEE Carbon Neutral Index include CATL(300750.SZ), LONGi Green Energy (601012.SH), BYD (002594.SZ), Zijin Mining (601899.SH), Changjiang Power (600900.SH), and Yuhong Waterproof (002271.SZ), representing various sub-sectors along the industry chain.